Comprehensive Guide to Form 13614- Rev 10-2025

Understanding Form 13614-

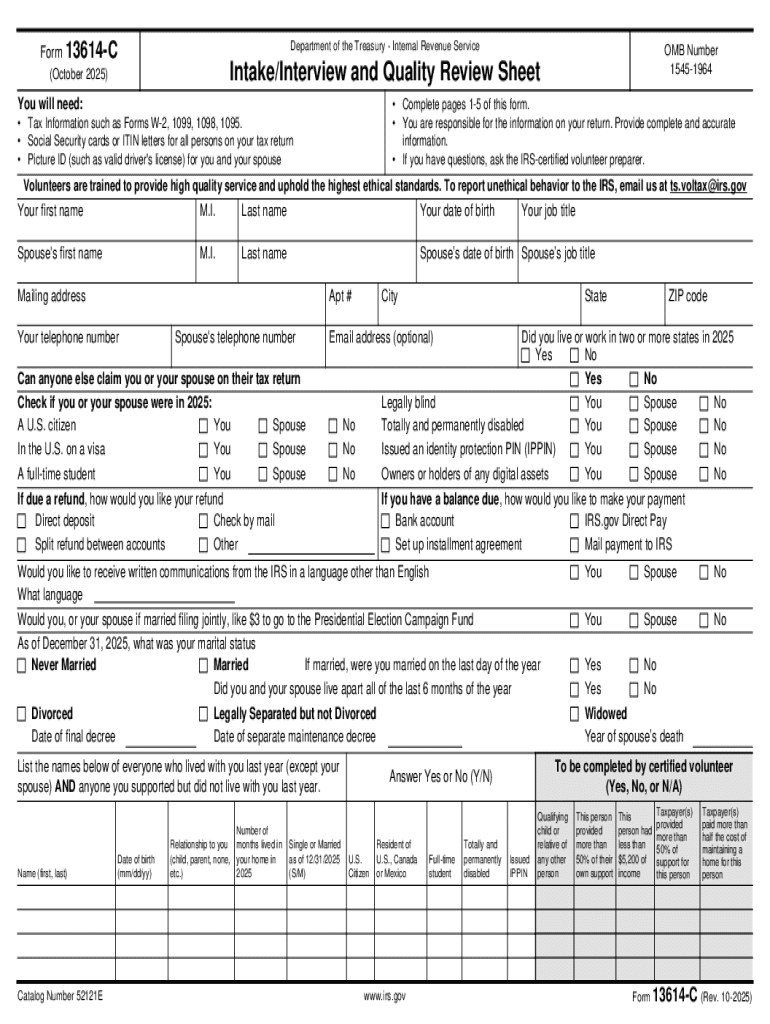

Form 13614-C, officially titled the 'Intake/Interview Sheet,' is a vital tool used during the tax preparation process, particularly aimed at streamlining interactions between taxpayers and tax preparers. Its primary purpose is to collect essential information necessary for preparing accurate tax returns, ensuring that all relevant details regarding a taxpayer's financial situation are thoroughly documented.

This form holds significant importance in tax preparation as it helps tax professionals assess the taxpayer's needs effectively and identify potential deductions or credits that could benefit them. By obtaining a detailed overview of the taxpayer's financial scenario, tax preparers can provide more personalized services and enhance the accuracy of the tax filings.

Who should use this form?

Form 13614-C is primarily tailored for individuals seeking assistance with their taxes, but it is equally vital for tax professionals who work with these individuals. This includes Certified Public Accountants (CPAs), enrolled agents, and volunteers participating in programs such as Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE).

Typically, scenarios for using Form 13614-C include those who need help navigating the complexities of the tax code, especially low-income individuals, the elderly, and families with dependents. The form aids in ensuring that all necessary details are captured before submitting tax returns, minimizing the risk of errors or omissions.

Key features of Form 13614-

Breaking down the structure of Form 13614-C reveals several key sections that cover various aspects of a taxpayer's financial situation. These sections include personal information, income details, deductions and credits, and other relevant information that could affect tax filing.

Common terms found within the form, such as 'adjusted gross income,' 'standard deduction,' and 'dependents,' can sometimes be confusing for those unfamiliar with tax terminology. It is essential to clarify these definitions to ensure complete and accurate completion of the form, making the process smoother for both taxpayers and preparers.

Step-by-step instructions for completing Form 13614-

Before filling out Form 13614-C, it is crucial to prepare by gathering all necessary documentation. This includes income statements such as W-2s and 1099s, previous tax returns, proof of expenses for deductions, and any additional records that pertain to credits or dependents.

When filling out the form, start with the personal information section, providing names, Social Security numbers, and contact information. As you progress to the income details, accurately report all sources of income, including wages, dividends, and any self-employment income. Next, address deductions and credits; it’s essential to know which apply to your situation to maximize your tax refund or minimize your liability.

Gather necessary documents like W-2s, 1099s, and previous tax returns.

Complete personal information section with accurate details.

Report all sources of income in the income details section.

Identify applicable deductions and credits to include in your filing.

Review the entire form for accuracy to avoid common mistakes.

Special considerations may arise when dealing with unique situations like multiple dependents or specific deductions eligible for certain qualifications. It is always advisable to seek clarification on these points to ensure optimal tax filing outcomes.

Editing and customizing your form 13614-

pdfFiller provides a user-friendly platform for editing Form 13614-C online. Users can readily upload the form and utilize various editing tools available on the pdfFiller platform. This includes inputting text, erasing unnecessary entries, and adding annotations where needed. These features assist in tailoring the form to fit individual needs.

Moreover, pdfFiller offers a variety of templates that can be customized for recurrent use. Users can save their changes and reuse forms in future tax seasons, promoting efficiency and consistency in document management. Leveraging templates streamlines the filing process, particularly for those who revisit similar circumstances year-over-year.

E-signing Form 13614-

A crucial aspect of completing Form 13614-C is the signature, which certifies that the information provided is accurate and complete. With the rise of digital documentation, e-signatures have become a practical and legally recognized method of signing forms. This method enhances convenience and expedites the submission process.

Using pdfFiller, e-signing the form is a straightforward process. Users can easily add their signature within the platform and can also send the form for signatures from others involved in the filing process. PDFFiller simplifies this entire workflow, making it easy to manage multiple signatures if needed.

Collaboration features of pdfFiller

Collaboration plays a vital role when multiple parties are involved in the tax filing process, particularly in more complex scenarios. pdfFiller allows users to share Form 13614-C seamlessly with team members or family members for review and input. This empowers all stakeholders to contribute to the compilation of necessary information.

Additionally, pdfFiller's collaboration tools enable tracking changes and comments made by different users. This functionality supports a more organized review process, allowing participants to provide feedback directly on specific parts of the form, ensuring clarity and reducing the likelihood of miscommunication during the preparation stage.

Managing your documents post-completion

After completing Form 13614-C, proper document management becomes essential. Organizing your forms effectively can save time during future tax seasons. This includes naming files appropriately, categorizing documents by year, and securely storing them in an easily accessible location.

When it comes to submitting the form to the IRS or other relevant entities, users have multiple options. Electronic submission methods promote efficiency, while those preferring traditional methods should ensure they securely mail the document to the correct address based on the filing instructions provided by the IRS. Both methods require attention to detail to ensure the form reaches its destination without delay.

Troubleshooting common issues

Taxpayers may encounter various challenges while filling out Form 13614-C. Frequently asked questions typically center around aspects such as how to correct errors, what to do if the form is incomplete or how to verify that submitted forms were received by the IRS. Knowing how to navigate these issues can significantly reduce stress during the filing process.

For assistance, contacting support can be essential. pdfFiller offers resources to help users navigate common questions related to document management and filling out forms. Additionally, the IRS provides guidance through its official website and helplines that address specific queries regarding form acceptance and submission statuses.

Staying informed about changes in tax forms

Tax laws and forms, including Form 13614-C, are subject to updates and changes. Keeping abreast of these changes is essential for accurate filing and compliance. Taxpayers and professionals should regularly review the IRS website or utilize trusted financial news outlets to stay informed about any relevant updates to tax forms or legislation impacting filing requirements.

Subscribing to updates from the IRS or relying on professional tax services can also help keep you updated regarding any new requirements or changes in forms, ensuring that you are always prepared for tax season—a proactive approach to tax preparation.

Success stories and user experiences

User testimonials highlight the platform’s effectiveness in simplifying the tax preparation process. Many individuals have shared their positive experiences utilizing pdfFiller alongside Form 13614-C, citing the ease of completion and the ability to collaborate with tax preparers as significant advantages.

Case studies reflect successful filing outcomes where users effectively navigated complex tax situations thanks to features provided by pdfFiller. These real-life examples serve to encourage new users to engage with the platform for their document management needs.